Agile HorizonsTM

A multi-asset approach

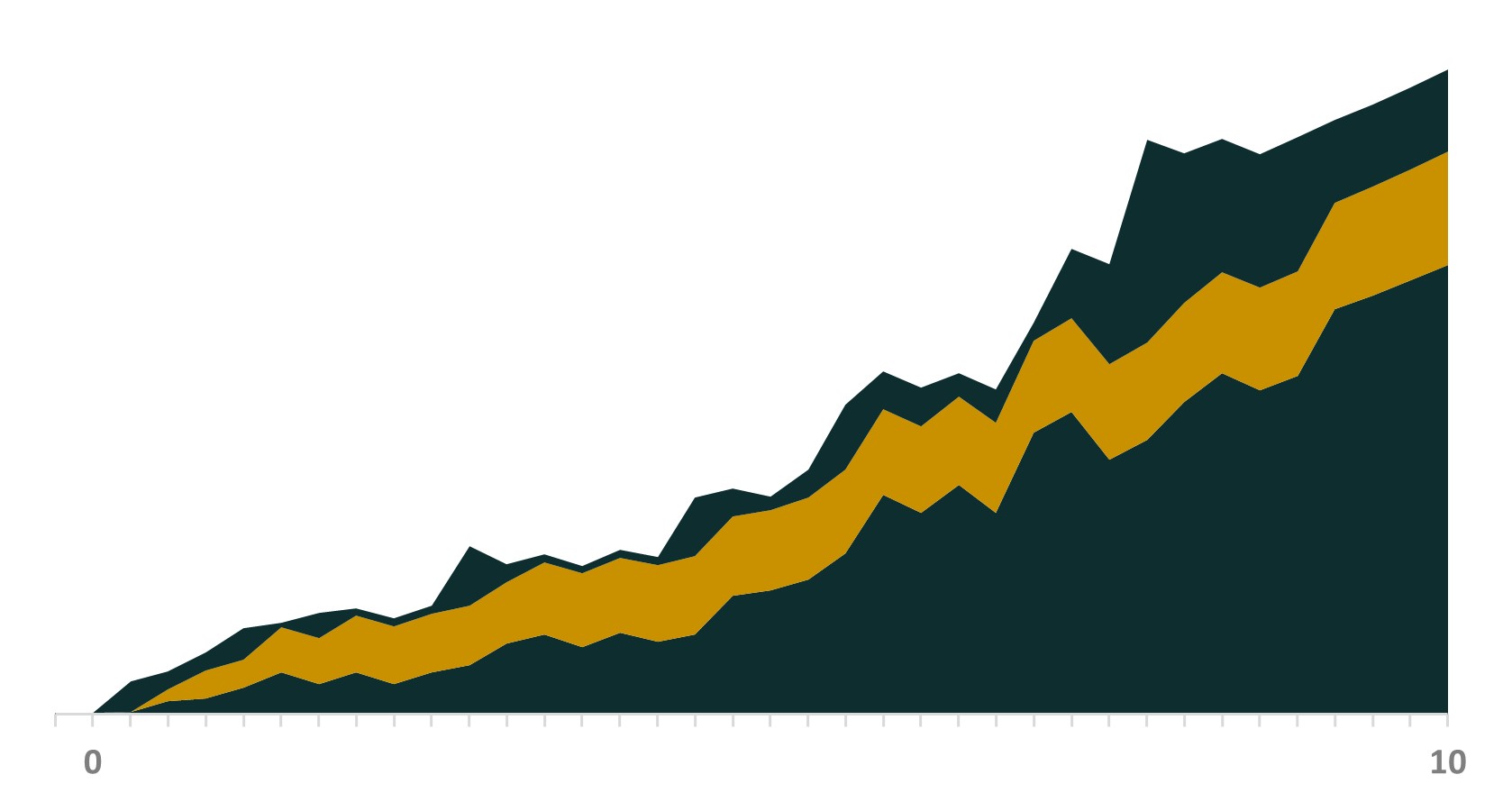

Relationships between Cleavemoor10’s asset classes allows increased flexibility and fast responses to market opportunities.

Through a hierarchy of liquidity we are able to offer flexibility and service to our investors whilst benefiting from high growth long horizon positions.

Our multi-asset approach allows us to generate value from the first day and to act on the best opportunities. Over a ten-year horizon these marginal differences make a big impact to overall performance.

This is the Agile Horizons™ strategy.

How we invest

01 The Agile Horizon Strategy

A combination of asset classes produces greater returns and optionality for investors when invested over a 10 year horizon. We are able to generate returns from day one whilst giving increased redemption optionality vs traditional strategies. Market volatility presents opportunities, our blend of asset classes means we are able to capitalise.

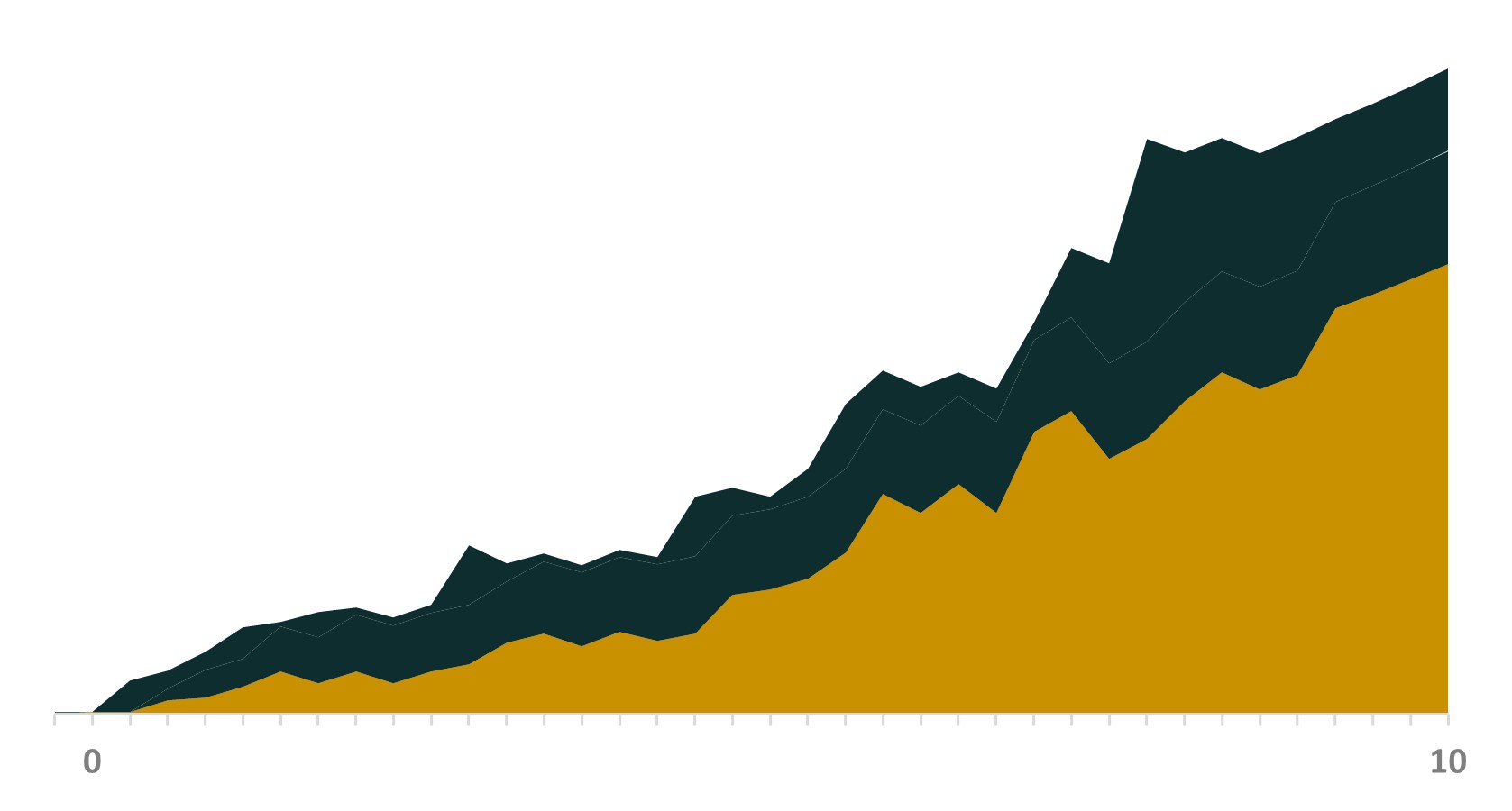

02 Global Equities

We use deep consumer sector knowledge to identify opportunities on both sides. Holding a strategic combination of long & short positions with a shorter horizon, we seek to compound returns while remaining agile. We aim to outperform in all market conditions. We use the liquidity of this asset class to be opportunistic in the private markets and give redemption optionality.

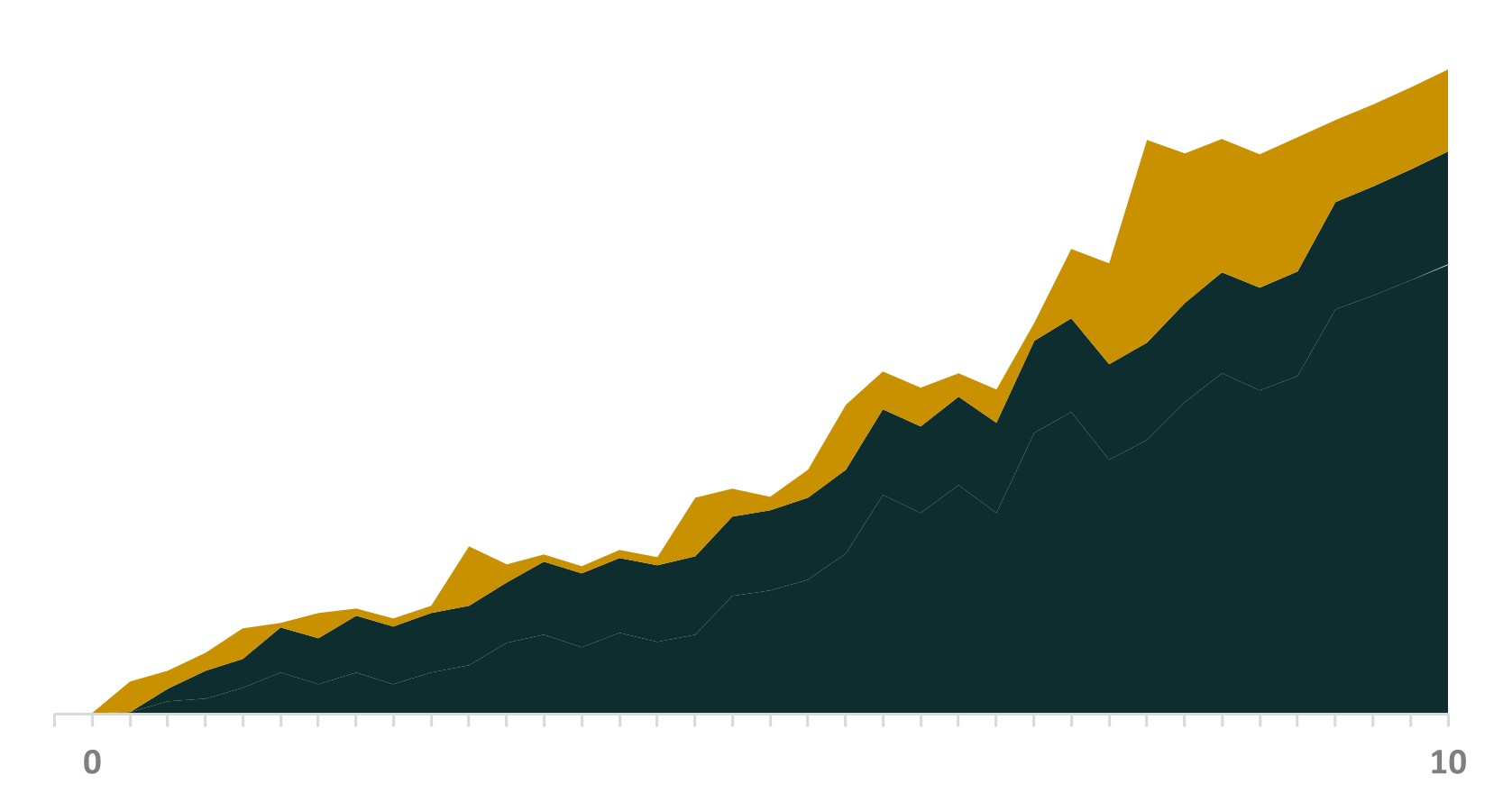

03 Private Equity

Unique growth opportunities in the private equity space offer large upside potential over a longer time horizon. With our industry knowledge and network, we are working with high-potential consumer companies. Our wealth of industry and management experience enables us to turbocharge our portfolio companies.